How to Increase a Retirement Fund: Homeowner Edition

A retirement fund is essential for anyone. But a good retirement fund is the ultimate goal. As you approach retirement age, it’s critical to ensure you have a sufficient retirement fund that allows you to live comfortably.

The best way to achieve a good retirement fund is to set aside money during your working life. However, this isn’t always possible – or at least not possible to the standard you’d hope for. But there are ways to maximize your retirement fund when retirement is not far off. This is especially possible if you are a homeowner in Philadelphia.

Jon’s parents set up their retirement fund when we were in high school. This was way back in the early 2000s. Now retired, they are living their life without having to worry about finances or sudden expenses. And that’s how it should be.

While talking to Jon’s parents, they offered insight on ways to build a retirement fund as homeowners. This is what they had to say, “Back then, it seemed like a daunting task. We didn’t know where to start, but setting up a retirement fund was essential for a secure future. It took a lot of research, but we found out several ways to achieve this, and our plan was set into motion.”

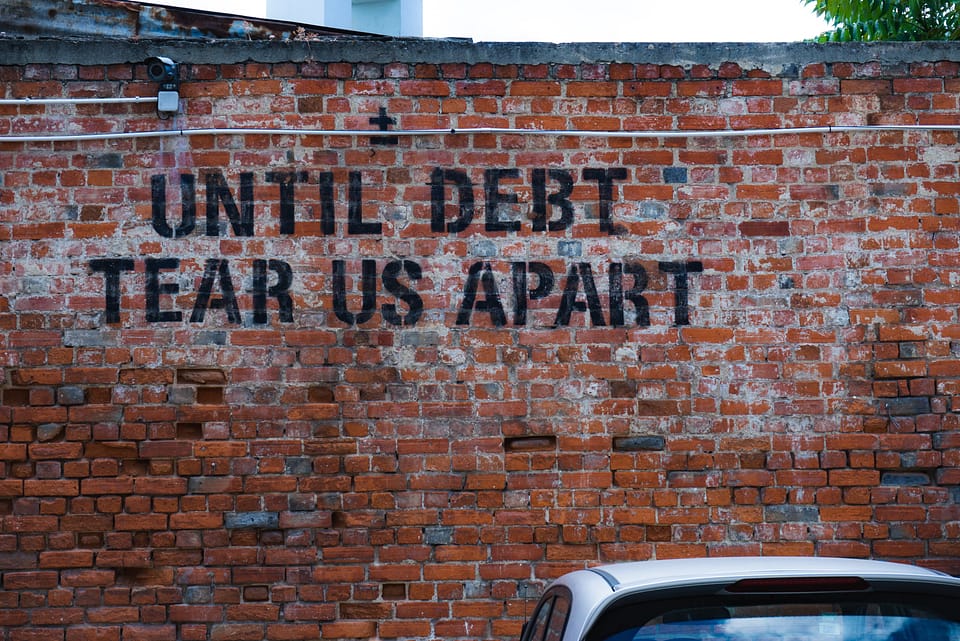

1. Crush the Debt

A large retirement amount can help with the expenses that come along with trying to sell a house in Philadelphia. Taking care of extraordinary obligations is a great way to support your retirement subsidize. Try not to commit the error of just creating the base installments on debt accounts. This will, without a doubt, be eaten up by intrigue and expenses, which will gradually be applied to your chief adjustments.

While conversing with a retirement fund specialist, I got the following advice: “Making enormous lump-sum installments to cut down your general equalization will save you thousands over the long haul, and leave you with more cash to add to your retirement fund. When you have your parities paid off, focus on taking care of the whole equalization consistently. This can help you increase your retirement fund and improve your FICO (Financing Corporation) score.”

2. Sell Properties Quickly & Affordably

On the off chance that you are a homeowner in Philadelphia and you want to answer this question of how to sell your house in Philadelphia, there are options for you out there! The most straightforward (and fastest) way to increase a retirement fund is to sell your property.

When selling a property fast, you may even have the option to arrange for the purchaser to pay a lion’s share of the expenses to have more cash to set aside. Selling a property can leave you with a cash lump sum.

Downsizing to a smaller home can also have other benefits (as well as helping increase a retirement fund). For example, it can save time, help you spend more time with family, and free up cash for other life events.

3. Use 401 (k) & Roth IRA to Buy Real Estate

You might have set up a 401 (k) with your company. You certainly need to put as much as possible into your 401 (k) to get the full advantage of free cash.

A few businesses coordinate half of the commitments up to a specific amount. Others may coordinate 100% or make stores regardless of whether you don’t.

Notwithstanding the 401 (k), you can have a Roth IRA (Individual Retirement Account) account. Through these accounts, your cash will be taxed. Try to maximize your Roth IRA contributions to make the most of this sparing opportunity.

4. Secondary Employment

Another approach to increase a retirement fund is to take on a subsequent activity. Presumably, if you’ve been working and paying a mortgage, your present place of employment can cover the entirety of the necessities now.

With this option, you will be sacrificing extra time. But it will free up more time (and leave you with more cash) when you retire. This option isn’t right for everyone, but it can be a great way to increase a retirement fund without having to sell a house.

For example, you can work a second job for 6 to 12 months to build a retirement fund before leaving

Thinking About Selling Your Philadelphia Home for Retirement?

If selling your home is on your retirement checklist, we buy houses for cash. Several clients nearing retirement decided to downsize their homes. It became easier as we purchased their homes and introduced them to sellers with reasonable homes that fit their retirement fund.

Your retirement fund is dependent on how you manage it. Think logically and be smart.